Profit First | 7 Bucket System for Businesses with Mike Michalowicz

Introduction

Cash flow is the lifeblood of any business. It’s the energy that keeps the machine running, the fuel that powers ideas into impact. Yet most businesses starve themselves of profit, pay the owner last, and leave financial health to chance. That’s why so many entrepreneurs burn out, stay stuck, or collapse under the weight of growth.

The Profit First method flips the game. Instead of hoping there’s money left at the end of the month, you design your system so that profit, taxes, and owner’s pay come first. Every dollar has a job, every bucket is protected, and your business finally serves you—not the other way around.

This 7-Bucket Allocation Model is your simple rhythm for stability and scale. Whether you’re a freelancer, consultant, coach, or running a multi-million dollar business, it works in any country, in any currency, at any stage. Plug in your income, allocate by percentage, and watch your business transform from fragile to flourishing.

Who is Mike Michalowicz?

- Serial entrepreneur who built and sold multi-million dollar businesses.

- Lost it all, then rebuilt his wealth by rethinking how money should flow in a business.

- Author of several bestsellers for entrepreneurs, including:

- Profit First – A cash flow management system that ensures you pay yourself first and build profit by design.

- The Pumpkin Plan – How to grow a remarkable business by focusing on your best customers and “pruning the vine.”

- Clockwork – How to design a business that runs itself.

- Fix This Next – A framework for diagnosing what’s truly broken in your business.

- All In – Leadership and team culture (his newest).

Profit First (his signature system)

- Flip the traditional formula:

- Most businesses: Sales – Expenses = Profit

- Profit First: Sales – Profit = Expenses

- By allocating money into separate “buckets” (Income, Profit, Owner’s Comp, Taxes, Opex), you force discipline and ensure you always have profit.

- Uses a percentage-based system (like in your buckets image) that you can adjust as your business matures.

- Prevents “leaky plumbing” where income comes in but disappears.

Why His Work Matters

- He addresses the 3 big reasons businesses fail (exactly what you noted earlier):

- No cash flow (no energy in).

- Poor money management (leaky container).

- Unsustainable growth (fragile foundations).

- His frameworks are simple, practical, and designed for small businesses, consultants, and entrepreneurs — not just big corporations.

🪣 The 7-Bucket System (Profit First Expanded)

1. Income Bucket

- The central “holding tank.”

- All revenue from sales lands here first.

- From this bucket, money is distributed (on a set rhythm, e.g., twice monthly) to the other buckets.

- ⚡ Energy In: This shows your true cash inflow before leaks.

2. Profit Bucket

- Skimmed off the top right away (even if small %).

- Builds a rainy-day fund, stability, and long-term wealth.

- Should not be touched for day-to-day expenses — it’s your business’s reward for existing.

- 🎯 Target: 5–20% depending on stage.

3. Owner’s Compensation Bucket

- Your salary equivalent.

- Ensures you get paid fairly for your time and energy.

- Prevents the “starving entrepreneur” trap.

- 🎯 Target: 10–30% (consultants/freelancers usually higher).

4. Tax Bucket

- Set aside for government taxes (income tax, GST/VAT, etc.).

- Prevents the year-end “surprise tax bill.”

- 🎯 Target: 15–30% depending on your country and business structure.

5. Operating Expenses (OPEX) Bucket

- Covers rent, subscriptions, marketing, admin, team wages, etc.

- By capping this, you force efficiency and avoid lifestyle creep in your business.

- 🎯 Target: 30–50%.

6. Cost of Sale / Materials Bucket

- Direct costs of delivering your product/service (suppliers, contractors, transaction fees, equipment).

- Keeps you aware of true margins.

- 🎯 Target: 10–25% depending on industry.

7. Growth / Experience / R&D Bucket

- Funds reinvestment: new offers, personal development, better client experiences, innovation.

- Helps avoid “fragile foundations” by strengthening your future model.

- 🎯 Target: 5–10%.

🔑 How It Works in Flow

- All money flows into Income.

- On a set schedule (twice a month recommended):

- Allocate % to Profit, Owner’s Comp, Tax, OPEX, Cost of Sale, Growth.

- Over time, you can adjust percentages based on your Spectrum Level (from survival → sustainability → scaling → legacy).

🌍 Why This Matters

- Protects profit first instead of hoping it’s “what’s left.”

- Prevents leaks (you can’t accidentally overspend if each bucket has a fixed allocation).

- Sustains growth — because you only scale with a strong financial foundation.

- Gives you peace of mind: every dollar has a job, and every job builds resilience.

🪣 7-Bucket System – Business vs. Personal

Business Buckets (Cash Flow Engine 💼)

- Income (100%)

- All client/customer payments land here first.

- Distribution point only.

- Profit

- Set aside for stability and future wealth.

- Untouchable except for quarterly distributions.

- Owner’s Compensation

- Your “salary” for working in the business.

- Pays you as the operator.

- Tax

- Covers company taxes (GST/VAT, corporate income tax, payroll tax).

- Operating Expenses (OPEX)

- Day-to-day business costs: marketing, rent, tools, wages, admin.

- Cost of Sale

- Direct delivery costs: suppliers, contractors, equipment, transaction fees.

- Growth / Experience / R&D

- Reinvestment into new products, training, innovation, events, scaling systems.

Personal Buckets (Life Flow Engine 🏡)

- Income (100%)

- All transfers from your Owner’s Comp (and Profit distributions) land here.

- Acts like a “personal paycheck.”

- Wealth / Investments (Profit Equivalent)

- Skim 5–20% for wealth-building: index funds, property, retirement accounts, compounding assets.

- Living Compensation (Salary Equivalent)

- Your lifestyle allowance (food, rent/mortgage, bills, essentials).

- Matches your chosen standard of living.

- Tax (if applicable)

- For personal income tax (depends on how your jurisdiction handles business vs. personal).

- Lifestyle / Discretionary (OPEX Equivalent)

- Restaurants, travel, shopping, entertainment — flexible “fun money.”

- Obligations / Debt Service (Cost of Sale Equivalent)

- Loan repayments, credit cards, fixed financial commitments.

- Growth / Experiences (Personal R&D)

- Courses, coaching, personal development, adventures, family experiences.

- Fuels personal expansion and prevents burnout.

🔑 How They Work Together

- Business feeds Personal.

- Owner’s Comp + Profit distributions from Business Buckets flow into your Personal Income Bucket.

- Both must be healthy.

- A leaky business bucket starves your personal life.

- A leaky personal bucket drains your freedom (no wealth accumulation).

🌱 Example Flow

- Business earns $20,000 this month.

- $2,000 → Profit

- $6,000 → Owner’s Comp → flows to personal

- $4,000 → Tax

- $6,000 → OPEX

- $1,000 → Cost of Sale

- $1,000 → Growth

- Personal receives $6,000.

- $600 → Wealth/Investments

- $3,000 → Living Compensation (rent, bills, food)

- $500 → Tax

- $900 → Lifestyle/Discretionary

- $500 → Debt Service

- $500 → Growth/Experiences

✅ End result: You get paid in both systems.

- Business is profitable and reinvesting.

- Personal life builds wealth while covering needs and fun.

🪣 Profit First Cash-Flow Allocation Model

🔹 Step 1: Set Up Buckets (Separate Bank Accounts)

- Income (100%) → Collection bucket (all revenue lands here).

- Profit → Business wealth, emergency cushion, reward.

- Owner’s Compensation → Your “salary” for running the business.

- Tax → Set aside for taxes (income, GST/VAT, corporate).

- Operating Expenses (OPEX) → Day-to-day business costs (rent, marketing, tools, admin, team).

(Optional advanced buckets: Cost of Sale, Growth/R&D, Debt Repayment.)

🔹 Step 2: Target Allocation Percentages (TAPs)

Mike Michalowicz suggests gradually working toward healthy ratios. Here’s a service-based business model under $1M annual revenue:

- Profit: 5–10%

- Owner’s Comp: 30–50%

- Tax: 15–20%

- OPEX: 30–40%

(Your starting percentages may differ — you adjust quarterly until you align with targets.)

🔹 Step 3: Allocation Rhythm

- Twice per month (e.g., 10th and 25th):

- Empty Income Bucket.

- Allocate percentages into each bucket.

- Operate ONLY from what’s in OPEX.

This creates discipline — if OPEX is low, you cut costs, not profit or salary.

🔹 Step 4: Example With $20,000 Monthly Revenue

- Profit (10%) → $2,000

- Owner’s Comp (40%) → $8,000

- Tax (15%) → $3,000

- OPEX (35%) → $7,000

👉 Notice: You pay yourself first, secure profit, and cap expenses.

🔹 Step 5: Quarterly Profit Distribution

- At quarter end, take 50% of Profit Bucket as a reward (bonus/dividend).

- Leave 50% in for stability and future growth.

🔑 Benefits of Profit First

- No more “feast and famine” cycles — cash flow is managed weekly.

- Protects YOU from being the last person paid.

- Builds profit and tax reserves automatically.

- Forces expenses to fit the business, not the other way around.

⚡ I can create a plug-and-play worksheet (Excel/Google Sheets) where you enter monthly revenue and instantly see how it splits across the buckets with both Target Allocation Percentages (TAPs) and your Current Allocation Percentages (CAPs). This way, you can track progress quarter by quarter.

Conclusion

When you master cash flow, you master energy. With every allocation you’re not just moving money—you’re strengthening the foundation of your business, building wealth that lasts, and creating freedom to grow on your terms.

If the system works, repeat it. If it doesn’t, adjust and try again next quarter. Over time you’ll find your golden thread—the model that fits your market, fuels your mission, and funds your future.

Profit is not an afterthought. It’s a habit, a rhythm, and a promise you make to yourself and your business. Start small, stay consistent, and let each quarter compound into momentum. Because a business that pays you first, protects its profit, and sustains growth is a business that lasts.

🪣 Master Prompt: 7-Bucket Profit First Cash-Flow Allocator

You are a world-class Profit First advisor.

Guide me step by step to create a 7-Bucket Profit First Cash-Flow allocation model for my business.

This model should work in ANY country, adjusting for tax systems and business types.

CONTEXT - Business type: {describe your business, e.g., coaching, consulting, e-commerce, restaurant} - Country: {country name for tax guidance} - Current or predicted monthly revenue: {amount in local currency} - Current expenses % breakdown (if known): {e.g., rent, payroll, marketing, debt service} - Stage of business: {Startup, Growth, Established, Scaling} - Owner’s current pay: {amount or %}

STEP 1 — Identify Buckets

Create a table of 7 Buckets: 1. Income (100%) – collection only, zeroed at allocation. 2. Profit – reserves + reward. 3. Owner’s Compensation – salary for the operator/owner. 4. Tax – government obligations (income, GST/VAT, payroll). 5. Operating Expenses (OPEX) – business overheads. 6. Cost of Sale (Materials/COGS) – direct costs to deliver product/service. 7. Growth / R&D / Experiences – reinvestment into future capacity and innovation.

STEP 2 — Target Allocation Percentages (TAPs) Suggest **healthy target percentages** for this business type + stage, inspired by Profit First benchmarks (adjusting for country norms).

STEP 3 — Current Allocation Percentages (CAPs)

Ask me for my actual current % allocations. Compare to TAPs and highlight gaps.

STEP 4 — Calculate Monthly Allocations

Based on revenue {amount}, create a breakdown table showing how much goes into each bucket monthly.

STEP 5 — Rhythm & Flow

Recommend a cash allocation rhythm (e.g., 2x per month, 10th and 25th).

Include guidance on: - How to zero out Income bucket each allocation. - How to use Profit bucket (50% retained, 50% quarterly distribution). - How to use Owner’s Comp (personal transfer rhythm). - Tax prep guidance based on country context.

STEP 6 — Scenario Planning

Run 2 extra models: - Conservative revenue scenario (80% of base). - Growth revenue scenario (120% of base).

Show allocations in each scenario.

STEP 7 — Action Plan Give me a **90-day roadmap** to move from my current allocations (CAPs) toward the ideal targets (TAPs), with small % shifts each quarter.

OUTPUT FORMAT - Clean Markdown tables for TAPs vs CAPs, and Monthly Allocations. - Short bullet-point action plan. - Country-specific notes on taxes. - Clear next steps I can act on today.

🔑 Why This Master Prompt Works

- Works globally (it asks for country upfront).

- Handles any business type (service, product, freelancer, etc.).

- Includes both Target Allocation Percentages (TAPs) and Current Allocation Percentages (CAPs) for realistic comparison.

- Bakes in cash rhythms (allocations 2x/month, quarterly profit distribution).

- Adds scenario planning to stress-test revenue swings.

- Produces a 90-day transition plan (so it’s gradual and sustainable).

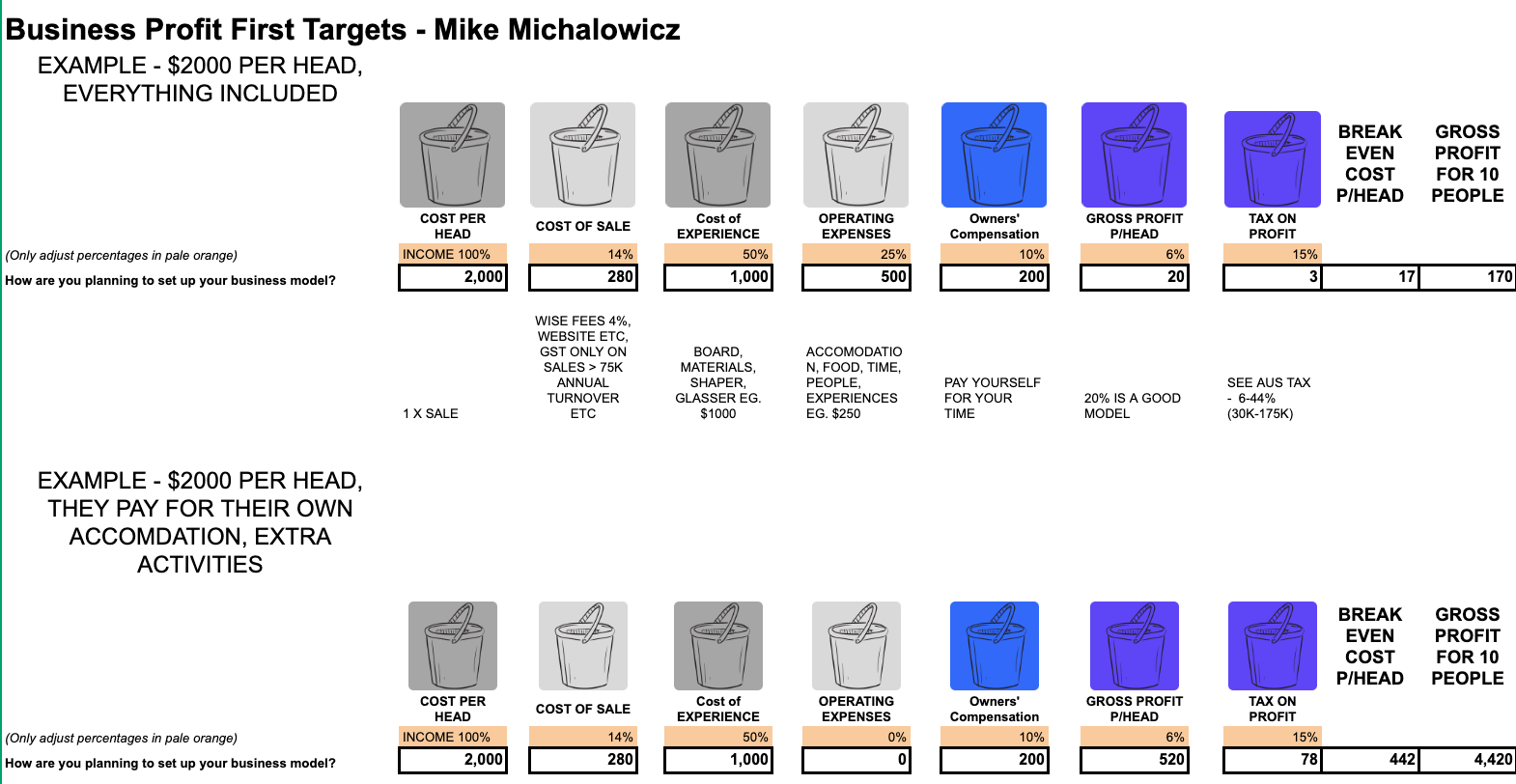

🪣 Profit First 7-Bucket Cash Flow Model | Example for Coaches and Retreat Leaders, 20k per month

(Example: Consulting / Retreat Business, $20K per month revenue)

Step 1 — Buckets

- Income (100%) → Holding account only, emptied twice per month.

- Profit → Long-term reserves + quarterly owner’s bonus.

- Owner’s Compensation → Salary for you as operator/founder.

- Tax → Income tax, GST/VAT, corporate tax.

- Operating Expenses (OPEX) → Marketing, subscriptions, admin, team, logistics.

- Cost of Sale → Direct retreat delivery costs (accommodation, food, facilitators, materials).

- Growth / R&D → Training, events, innovation, scaling capacity.

Step 2 — Target Allocation Percentages (TAPs)

For a service/experience-based business under $1M annual revenue:

| Bucket | Target % | Notes |

|---|---|---|

| Profit | 5–10% | Stability + reward fund |

| Owner’s Compensation | 35–45% | Pays you first |

| Tax | 15–20% | Depends on country |

| Operating Expenses | 20–30% | Overheads + salaries |

| Cost of Sale (COGS) | 10–20% | Direct retreat delivery |

| Growth / R&D | 5–10% | Innovation & future-proofing |

| TOTAL | 100% | Allocated each cycle |

Step 3 — Current Allocation Percentages (CAPs)

(From your earlier retreat model analysis)

| Bucket | Current % (Est.) | Target % |

|---|---|---|

| Profit | 1–2% | 5–10% |

| Owner’s Compensation | ~10% | 35–45% |

| Tax | 5–10% | 15–20% |

| Operating Expenses | ~25% | 20–30% |

| Cost of Sale (COGS) | 50% | 10–20% |

| Growth / R&D | ~2% | 5–10% |

| TOTAL | 100% | 100% |

👉 Gap: You’re overloaded in COGS (too much included in retreat price) and underpaying yourself + profit bucket.

Step 4 — Monthly Allocations ($20K Example)

| Bucket | Target % | Monthly Allocation |

|---|---|---|

| Profit | 7% | $1,400 |

| Owner’s Compensation | 40% | $8,000 |

| Tax | 18% | $3,600 |

| Operating Expenses | 25% | $5,000 |

| Cost of Sale (COGS) | 7% | $1,400 |

| Growth / R&D | 3% | $600 |

| TOTAL | 100% | $20,000 |

Step 5 — Rhythm & Flow

- Income Bucket: All deposits land here.

- Twice Monthly (10th & 25th): Empty Income → distribute to Profit, Owner’s Comp, Tax, OPEX, COGS, Growth.

- Profit Bucket:

- Hold untouched.

- Quarterly: 50% distribution (bonus), 50% retained.

- Owner’s Comp: Transfer to personal twice monthly (synchronised with allocations).

- Tax: Never touch. Paid direct from bucket.

- OPEX/COGS: Daily business operations draw only from these.

Step 6 — Scenario Planning

Base ($20K/month): → see table above.

Conservative (80% = $16K):

| Bucket | % | Allocation |

|---|---|---|

| Profit | 7% | $1,120 |

| Owner’s Comp | 40% | $6,400 |

| Tax | 18% | $2,880 |

| OPEX | 25% | $4,000 |

| COGS | 7% | $1,120 |

| Growth | 3% | $480 |

Growth (120% = $24K):

| Bucket | % | Allocation |

|---|---|---|

| Profit | 7% | $1,680 |

| Owner’s Comp | 40% | $9,600 |

| Tax | 18% | $4,320 |

| OPEX | 25% | $6,000 |

| COGS | 7% | $1,680 |

| Growth | 3% | $720 |

Step 7 — 90-Day Action Plan

- Month 1:

- Open 5–7 separate bank accounts.

- Start allocating with current % (CAPs).

- Track actual spends per bucket.

- Month 2:

- Shift 2–3% from COGS into Profit + Owner’s Comp.

- Cut/restructure “everything included” retreat model → shift costs back to guest.

- Month 3:

- Increase Profit bucket to 5%.

- Raise Owner’s Comp toward 25–30%.

- Hold OPEX steady.

👉 Each quarter, shift closer to TAPs until aligned.